Making the Most of Your Credit Card

A growing number of Americans are moving towards a “cashless” society. As a result, credit cards are being used more often than ever — especially by those with higher incomes.1

Credit cards are no longer viewed solely as a debt instrument for cash-strapped individuals. Instead, they are prized for a variety of benefits, such as earning rewards and travel perks, protecting purchases, building credit, and gaining additional insurance coverage.

Reap the rewards

Using a rewards credit card for everyday purchases can provide you with valuable perks. Some rewards cards will offer a percentage of cash back for every dollar spent on certain purchases (e.g., dining; travel) or the ability to apply rewards towards a statement credit. Others offer travel rewards that can be used to purchase airline miles and hotel accommodations. Certain rewards cards can even provide you with entrance into VIP airport lounges and early access to purchase tickets for concerts and sporting events. Many rewards cards offer additional sign-up bonuses, such as double cash back or bonus miles/points for new customers if you charge a certain amount on the card within a specified period of time.

The disadvantages of a rewards card are that it can often come with a higher interest rate or charge an annual fee. So if you tend to carry a balance on your card, you could end up paying more in interest than you would earn in rewards. In addition, it is important to read the fine print and fully understand the terms and conditions of the rewards offered. You’ll also want to periodically check in with your card issuer to see if any of the terms and/or conditions of the offer have changed.

Protect your purchases

One of the main advantages of using a credit card is that you have greater protection for your purchases than you would if you use cash or a debit card. If your credit card is lost or stolen, you generally are liable for no more than $50 in fraudulent/unauthorized charges. Credit cards also come with additional fraud protection in the form of fraud alerts that are sent immediately to you by email or text message when suspicious charges are detected.

Your credit card may also provide extended warranties and/or extra purchase protection for high-cost items bought with the card, such as a TV or laptop.

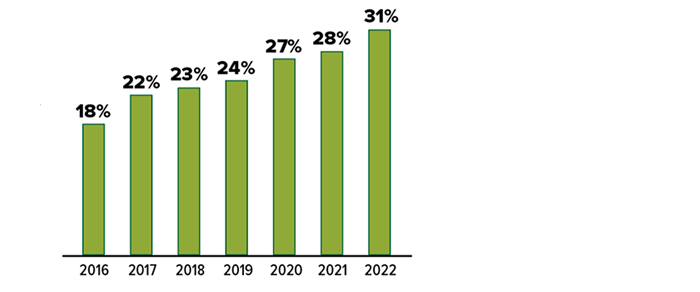

Share of payments made by credit card

Source: Federal Reserve, 2023

Build your credit

Using a credit card is an excellent way to build credit and improve your credit score. There are a variety of factors that go into determining your credit score, such as your payment history, outstanding debt, and how close your balances are to their account limits.

In order to use a credit card to build and/or improve your credit, you should be sure to consistently pay your full monthly balance on time and keep your balance below your credit limit.

Gain additional insurance coverage

Many credit cards provide you with additional insurance coverage for particular circumstances. For example, if you use your card to rent a car, you may be covered by auto rental insurance to protect you in case of damage or theft. If you use your card to purchase a trip, it may offer travel interruption insurance if your trip is canceled for a covered reason. Your credit card may even provide coverage for a lost or damaged cell phone if you purchased your cell phone or pay your cell phone bill with your card.

Use your card wisely

The key to making the most of your credit card is to use your card wisely and avoid falling into common credit card traps. Here are three tips for using your credit card responsibly:

- Only charge what you can afford and pay the full balance due each month.

- Avoid missing payments by signing up for automatic payments and account alerts.

- Try to keep your balance well below your credit limit.

Contact Us

Contact Us